Types and Usage

A cheque is a document issued by an individual to his or her bank, directing them to pay the person whose name is mentioned in the document the sum specified in it for such a document to be valid, it is important that the person issuing it has an account in the said bank. An issuer of the cheque is called drawer, and the one to whom it is issued is the drawee.

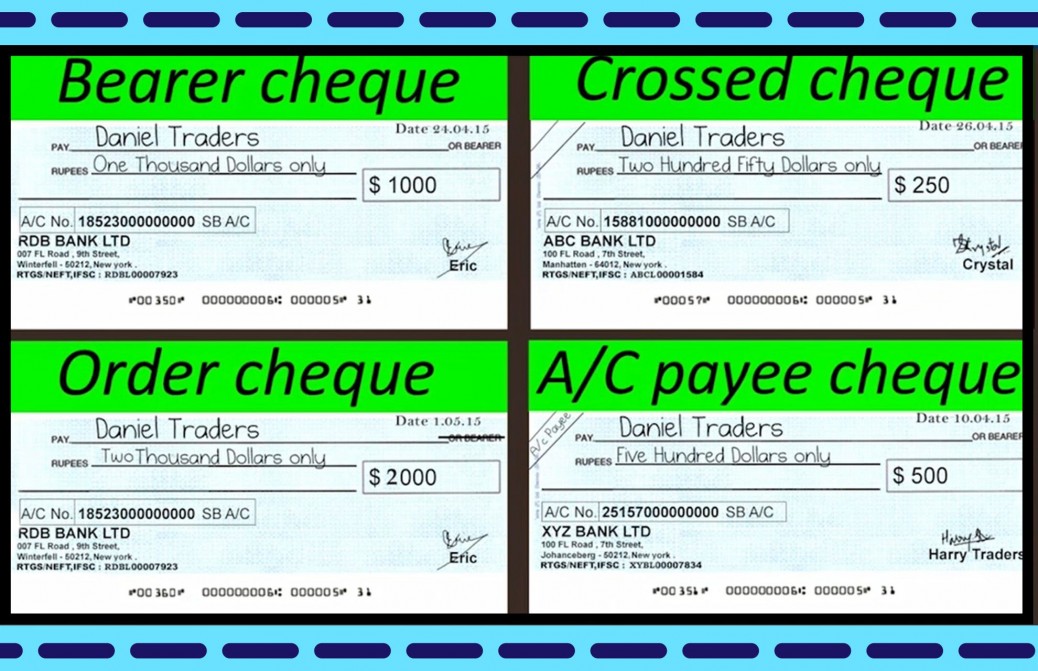

Types of Cheque:

Some of the most common types of cheque are listed here.

1. Bearer Cheque: The first among the types of cheques is the bearer cheque. This cheque is payable to the bearer of the check or whose name the cheque carries in the column meant for the name of the drawee. Ideally, this cheque has “or bearer” printed at the end of the dotted lines, which is meant to have the name of the drawee.

2. Order Cheque: In this cheque, the printed word “bearer” is canceled thereby making it payable only to the person whose name is written in the place of drawee.

3. Crossed Cheque: In a crossed cheque, the drawer makes two parallel transverse lines at the top left corner of the cheque with or without writing “a/c payee”. This makes sure that no matter who presents the cheque to the drawer bank, the transaction is made into the account of the person named in the cheque only.

4. Open Cheque: Also known sometimes as an uncrossed cheque. Any cheque that is not crossed comes under open cheque category. This cheque can be presented to the drawer’s bank and is payable to the person presenting it. The drawee of this cheque can also transfer it to another person by writing their name on the cheque and thereby making them the drawee.

5. Post- Dated Cheque: A cheque bearing a later date than the one on which it is actually issued, is called as a post-dated cheque. This cheque maybe presented to the drawee bank at any time after its issuance, but the money will not be transferred from the account of the payer until the date mentioned on the cheque.

6. Stale Cheque: As the name suggests, a stale cheque is one which is past its validity period and can no longer be encashed. Initially, this period was six months from the date of issue. Now, this period has been reduced to three months.

7. Travelers’ Cheque: These may be equated with a universally accepted currency. A travelers’ cheque is available almost everywhere and comes in various denominations. This is an instrument issued by the bank itself to make payments from one place to another.

8. Self Cheque: The drawer usually issues a self-cheque to his or her self. The name column of the drawee has the word “self” written in it. A self-cheque is drawn when the drawer wishes to withdraw money from the bank in cash for his use.

9. Bankers Cheque: A banker’s cheque, as is self-explanatory here, is a cheque issued by the bank on behalf of the account holder in order to make payment of a specified sum, by order, to another person within the same city. It is valid only for three months from the date of issue, but if needed, can be re-validated upon fulfilling certain legal obligations.

Tags: Be Conscious Of Karma Growth Opportunity